How do covered call ETFs work? And why might they (or might not) suit you?

- Ben Tan

- Jun 26, 2025

- 3 min read

My circle of friends would know that I love collecting extra cash by selling covered calls on stocks that I hold.

But if you are someone who doesn’t have the time to look at what covered calls to sell, and yet you are looking for a way to earn a steady income while adding a layer of protection, covered call ETFs might be the answer.

How does a covered call ETF work?

A covered call ETF buys shares of companies and simultaneously sells call options on those shares. When an ETF sells a call option, it gives the buyer the right to purchase the shares at a predetermined price, known as the strike price, within a specific timeframe. In return, the ETF receives a premium from the buyer.

If the share price stays below the predetermined price, the ETF keeps both the shares and the premium.

If the share price rises above the predetermined price, the buyer may exercise the option, and the ETF sells the shares at the predetermined price while keeping the premium.

For example, the Global X Nasdaq 100 Covered Call ETF follows a “covered call” or “buy-write” strategy. It buys the Nasdaq 100 Index stocks and sells corresponding call options on the same index.

Selling call options on owned shares is a classic strategy to generate income. One downside is the effort and capital required to buy enough shares to cover the sold options. This means you must buy 100 shares of the Nasdaq 100 Index to sell one covered call option.

Covered call ETFs simplify this process by managing the strategy on behalf of investors.

They buy the underlying stocks, select strike prices, and sell the call options. This frees you from the time commitment and potential missteps of individual option trading.

Furthermore, investing in a covered call ETF might involve fewer fees and lower costs than managing the options strategy independently.

Covered call ETFs also offer built-in diversification, similar to other ETFs. By pooling your investment with others, you gain exposure to a basket of stocks, reducing your risk compared to holding just a single security.

Perhaps the biggest perk of covered call ETFs is the income generation.

The premiums received from selling call options translate into regular dividend payouts for investors. These dividends can be higher than what you might receive from a traditional ETF, boosting your overall returns.

However, these premiums depend on several factors, and market volatility is the most significant driver. This means that the performance of covered call ETFs depends on the market's mood.

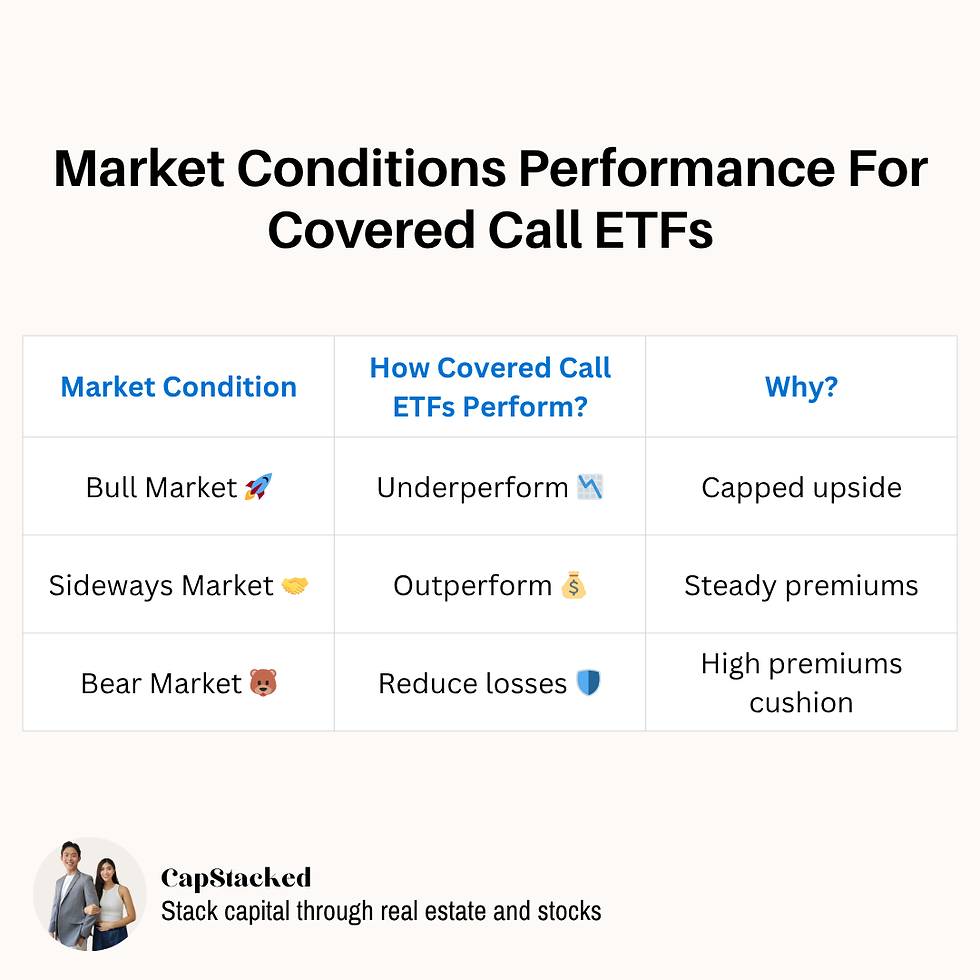

In bullish years, these ETFs tend to lag behind the S&P 500. This is because the strategy focuses on generating income through selling call options rather than capital gains. By selling calls with a strike price slightly higher than the current market value, the ETF earns premiums but limits its upside potential, resulting in underperformance in rising markets.

Conversely, during bearish years, when fear and volatility are high, covered call ETFs can help reduce losses. The large premiums earned from selling call options provide a cushion against falling prices.

After a market crash, when volatility remains elevated, covered call strategies can produce respectable returns. This is because the premiums received are higher, thanks to the increased volatility and the closer strike prices.

As such, these ETFs perform best in sideways or down markets, where the consistent income from premiums can offset the lack of capital gains.

Sidetrack a bit. If you think volatility is risky, you may be looking at it incorrectly. This article I wrote will explain to you why.

So, who is best for covered call ETFs?

Covered call ETFs suit investors who prioritise income generation over explosive growth. These funds are ideal for those seeking a more conservative investment approach with regular dividends and potential downside protection.

These ETFs may also be well-suited for a diversified retirement portfolio, particularly for those seeking income-generating strategies.

That said, covered call ETFs aren't for everyone. While they offer more potential returns than bonds, they also carry more risk. Unlike traditional ETFs, they cap their upside potential by selling call options. This is the primary reason I avoid it.

Besides the capped upside, I am already actively selling covered calls on the stocks I hold that can provide much higher total returns.

The bottom line? If consistent income and some protection from market dips are your top priorities, a covered call ETF could be a solid fit for your portfolio. Just remember, it comes at the expense of potentially explosive growth.

Comments