Step-by-step guide to buying private property in Singapore (made simple).

- Vann Lim

- May 29, 2025

- 3 min read

Updated: Jun 3, 2025

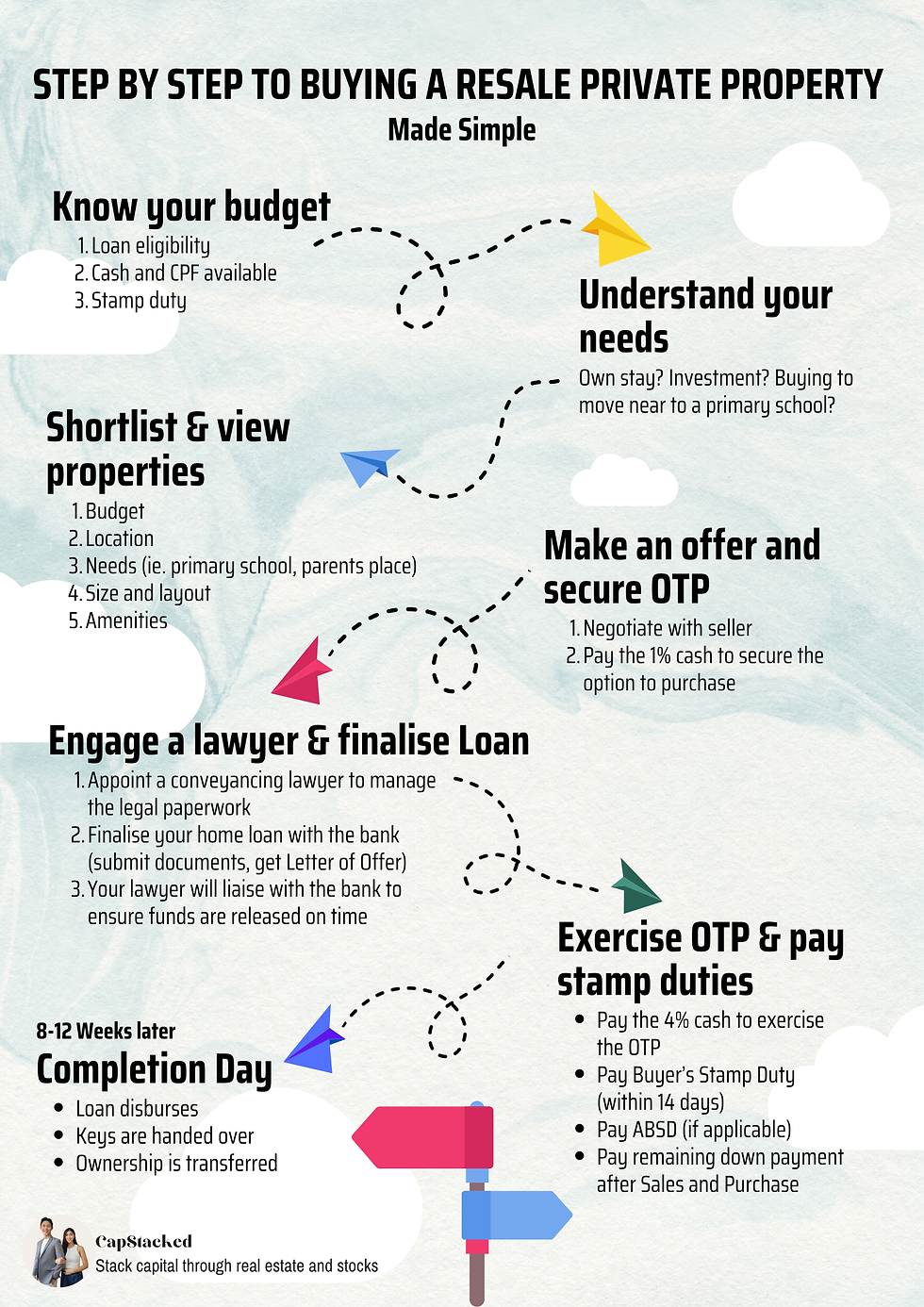

Step 1: Know your budget

Before viewing any property, it's essential to know your budget. Here’s how: Use the three key budget checks:

Loan Eligibility: Use the TDSR Calculator to check how much loan you can get based on your income and existing debts.

Cash & CPF Available: These are needed for down payment, legal fees, stamp duties, and other initial costs.

CPF Ordinary Account (OA)

Cash in the bank

Stamp Duties Calculate your Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD) if you’re buying a second or third property using this IRAS Stamp Duty Calculator.

Step 2: Understand your needs and goals

Ask yourself:

Are you buying to stay or to invest?

Do you need to be near schools or the MRT access?

Do you want to stay in CCR, RCR or OCR?

Do you prefer a leasehold or freehold property?

How many bedrooms do you need ideally?

Clarifying these helps both you and your agent identify and filter through the most suitable options available.

Step 3: Engage the right property agent

Many buyers think they can manage the process on their own. But here is why engaging a professional matters:

We help navigate complex rules, especially loan restrictions, CPF usage, and timeline coordination.

We help negotiate pricing based on market data and comparable sales. Data that you wouldn’t be able to find right off the internet

You get access to off-market listings, show flat previews, and developer promos.

We handle paperwork, deadlines, and liaise with bankers and lawyers so you don’t miss a step.

You pay only 1% when engaging Ben and Vann for a private property purchase. This is because we are at an advantage when we don’t co-broke with a seller’s agent. There is more incentive for the seller’s agent to negotiate the pricing as they do not need to share the commission with us.

When something as big as a property purchase is at stake, professional guidance helps you avoid costly mistakes and stressful delays.

Step 4: View properties that match your profile

Explore various platforms, such as PropertyGuru and 99.co, or connect with us for exclusive early access to new, resale listings, or undervalued picks.

When searching for your ideal property, consider the following factors to refine your options:

Budget

Preferred location

Unit size and layout

As part of our service in selecting a property that matches your profile, we evaluate all the options through our moat analysis framework to ensure long-term defensibility while aligning with your goals.

Step 5: Make an offer and secure the OTP

Once you find a unit you like:

Negotiate with the seller or the developer on price.

Pay a 1% option fee in cash to secure the Option to Purchase (OTP).

You have 14 days to exercise the OTP by paying the next 4% in cash.

The OTP legally reserves the unit for you. Failing to exercise it means losing the 1% fee.

Step 6: Appoint a lawyer and finalise the home loan

Choose a conveyancing lawyer to:

Handle all legal documentation.

Liaise with your bank for the disbursement of funds.

Manage caveats, titles, and timelines.

Your banker will also issue a Letter of Offer, confirming your approved loan amount and terms.

Step 7: Exercise OTP and pay stamp duties

Within 14 days of securing the OTP:

Exercise your OTP with the seller.

Pay the Buyer’s Stamp Duty (BSD).

Pay ABSD if applicable (second or third property buyers).

You can use CPF to cover stamp duty if you have sufficient funds in your OA. Stamp duties are first payable by cash and reimbursed from your CPF OA later.

Step 8: Completion day (Usually 8-12 weeks later)

This is when:

Funds are transferred from the bank to the seller.

Keys are handed over.

Legal ownership is transferred to you.

Congratulations—you’re officially a private property owner in Singapore!

Why does guidance matter?

Buying private property is a significant milestone and one of the biggest financial commitments you will make. Instead of guessing your numbers or searching online for answers, let us assist you with:

Financial structuring, needs analysis and goal alignment.

Using our selection framework for the right property.

Negotiation.

Complete transaction guidance from start to finish.

Post-purchase support, such as rental.

We are here to help you take the next step with clarity and confidence. You can view the complete list of services and fees here.

Contact us today for a no-obligation consultation.

Comments