The surprising connection between fitness and finances.

- Ben Tan

- May 21, 2025

- 2 min read

Updated: May 21, 2025

Physical fitness and personal finance may seem like separate worlds, but the skills and habits you develop in one can have a direct benefit for the other.

I’ve been working out since my late 20s and paying attention to my finances since my early 20s. Over the years, I’ve noticed striking similarities between the two:

First, both require long-term thinking. Like really long-term.

The results don’t appear immediately; they take months or even years. Getting discouraged is easy when immediate results aren't apparent, but staying committed is crucial.

Setting up a workout routine and automating my finances took about three months to become habitual. I had to push through the initial discomfort during this adjustment period to reap the rewards. But the satisfaction of seeing progress motivated me to continue.

Next is discipline.

You can’t build the habit of going to the gym if you’re constantly lazy, just as you can’t save money if you don’t address habitual spending, like buying a $5 Americano every morning.

Breaking old habits is tough because new ones require effort to form.

To start exercising regularly, I began with just a short thirty-minute workout. Similarly, reducing unnecessary spending gradually can help you break the cycle of overspending without feeling deprived.

Another key concept is compounding.

Compound growth means building on what’s already there. It can work for or against you.

For example, investing money over a long period lets compound interest do most of the work. On the other hand, an unhealthy diet from a young age can lead to exponential health problems later in life. Whether you’re aiming to improve your finances or your fitness, small, positive decisions add up over time.

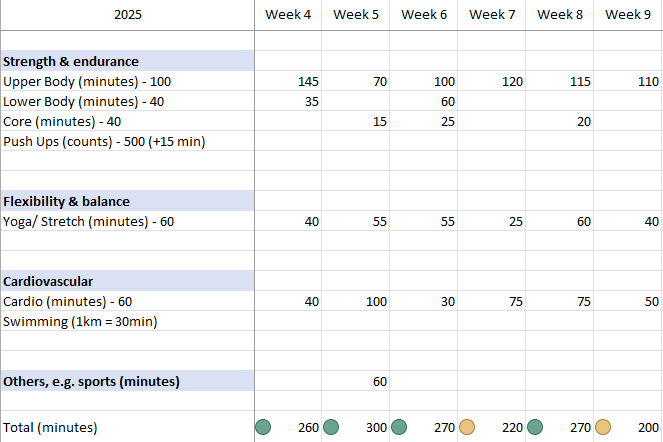

Tracking your progress is also crucial.

Recording the numbers isn’t always easy, but it’s effective. I used to think I ate enough calories until I started tracking them. Similarly, I didn’t realise how much I was spending on Grab delivery until I began budgeting.

Anything you track tends to improve over time. Without tracking, you may miss out on growth opportunities. Keeping tabs on your progress helps you stay motivated and focused.

Finally, education and learning play a huge role in success. The more you learn about a topic, the better decisions you can make.

Credit card companies make billions from interest payments. Learning how to pay off your credit card bill fully can save you money in the long run. In fitness, injuries often occur due to poor form or not warming up properly. Whether you prefer books, online courses, or podcasts, continuous learning is key to long-term success.

Oh yes! And don’t forget always to celebrate your achievements, no matter how small.

Whether saving $100 or completing an hour workout, acknowledging your progress reinforces your commitment to your goals. Imagine the positive impact of consistent progress over the next decade or two!

Progress takes time.

Patience and dedication are essential if you want your plans to work. Though it may be challenging, in the years and decades to come, you’ll thank yourself for improved mental and physical health, lower financial stress, and a reduced risk of chronic diseases.

So, don't give up!

Comments